Navigating The Landscape: A Guide To Onondaga County’s Tax Map

By admin / June 22, 2024 / No Comments / 2025

Navigating the Landscape: A Guide to Onondaga County’s Tax Map

Related Articles: Navigating the Landscape: A Guide to Onondaga County’s Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape: A Guide to Onondaga County’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: A Guide to Onondaga County’s Tax Map

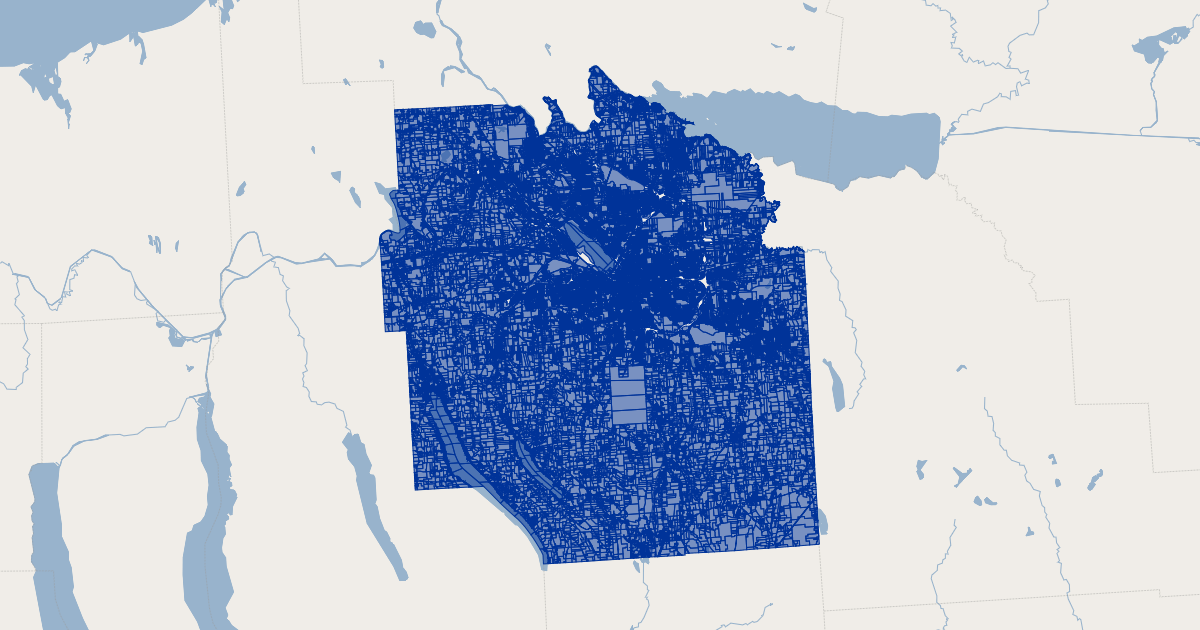

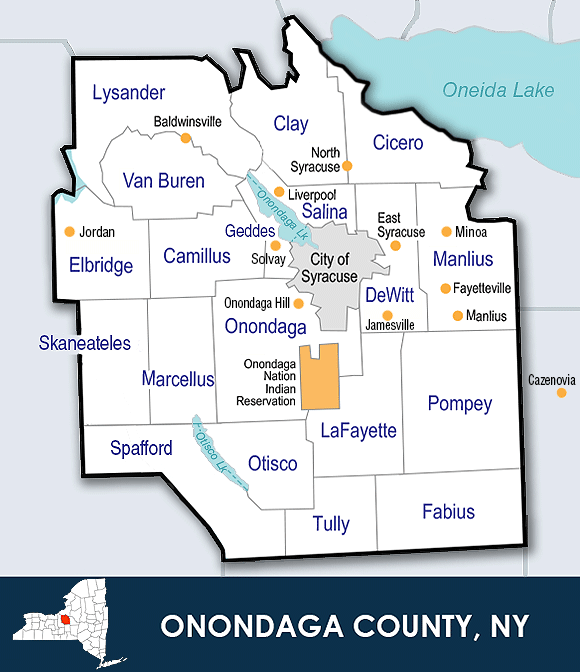

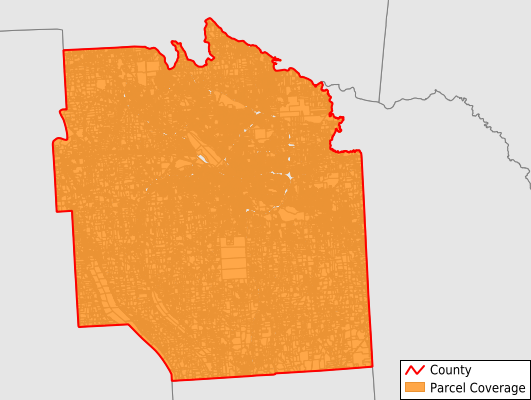

The Onondaga County Tax Map is a vital resource for understanding the county’s property landscape. It serves as a comprehensive and detailed visual representation of every parcel of land within the county, offering a wealth of information for various purposes. This article aims to provide a comprehensive overview of the Onondaga County Tax Map, exploring its structure, uses, and importance for individuals, businesses, and government entities.

Understanding the Structure

The Onondaga County Tax Map is organized into a grid system, dividing the county into distinct sections known as "tax districts." Each district is further subdivided into smaller units called "blocks," which are then broken down into individual "lots." This hierarchical structure allows for precise identification and location of any property within the county.

Key Components of the Tax Map

The Tax Map contains a multitude of data points for each property, including:

- Parcel Number: A unique identifier assigned to each individual property.

- Address: The official street address associated with the property.

- Owner Information: Details about the current property owner(s), including name and contact information.

- Property Type: Classification of the property, such as residential, commercial, or industrial.

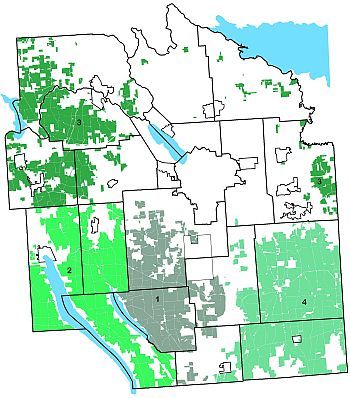

- Land Use: The primary function of the property, such as single-family dwelling, office building, or vacant land.

- Zoning: The specific zoning regulations applicable to the property, outlining permitted uses and development restrictions.

- Acreage: The total area of the property measured in acres.

- Dimensions: The length and width of the property, providing a visual representation of its size.

- Assessment: The estimated market value of the property, used for property tax calculations.

Accessing the Tax Map

The Onondaga County Tax Map is readily accessible to the public through various channels:

- Online Access: The Onondaga County Real Property Services website provides an interactive map interface, allowing users to search for specific properties, view parcel boundaries, and access detailed property information.

- Physical Copies: Hard copies of the Tax Map are available for viewing and purchase at the Onondaga County Real Property Services office.

Uses of the Tax Map

The Onondaga County Tax Map serves a wide range of purposes, benefiting individuals, businesses, and government agencies:

- Property Ownership Verification: The Tax Map provides a reliable source for verifying property ownership and legal descriptions, crucial for real estate transactions, title searches, and legal proceedings.

- Property Valuation: The assessment information included in the Tax Map assists in determining the estimated market value of properties, aiding in property tax calculations, refinancing, and property sales.

- Planning and Development: Developers, architects, and urban planners utilize the Tax Map to understand property boundaries, zoning restrictions, and available land for potential projects, facilitating informed planning and development decisions.

- Property Management: Landlords, property managers, and real estate agents rely on the Tax Map to identify properties, track ownership changes, and manage property portfolios effectively.

- Emergency Response: The Tax Map assists emergency services in identifying property locations, navigating complex terrains, and providing efficient response during emergencies.

Benefits of the Onondaga County Tax Map

The Onondaga County Tax Map offers numerous benefits, contributing to a transparent and efficient property management system:

- Transparency and Accountability: The publicly accessible nature of the Tax Map promotes transparency in property ownership, assessment, and land use, fostering accountability within the county government.

- Informed Decision-Making: The comprehensive information provided by the Tax Map empowers individuals, businesses, and government agencies to make informed decisions regarding property transactions, development projects, and land management.

- Economic Development: By providing clear and accessible information about property availability and zoning regulations, the Tax Map facilitates economic development by attracting investment and promoting sustainable growth.

- Efficient Resource Allocation: The Tax Map assists in optimizing the allocation of resources by providing accurate data on property values, land use, and development potential, informing government policies and investments.

Frequently Asked Questions (FAQs)

Q: How can I find a specific property on the Onondaga County Tax Map?

A: The Onondaga County Real Property Services website offers an interactive map interface. You can search for properties by address, parcel number, or owner name.

Q: What is the difference between a lot and a block on the Tax Map?

A: A block is a larger geographical area encompassing multiple properties. A lot is a specific parcel of land within a block, representing an individual property.

Q: How often is the Onondaga County Tax Map updated?

A: The Tax Map is updated regularly to reflect changes in property ownership, zoning regulations, and other relevant information. Updates are typically made annually.

Q: Can I make changes to the Tax Map myself?

A: No. Only authorized personnel from the Onondaga County Real Property Services department can make changes to the Tax Map.

Q: What should I do if I find an error on the Tax Map?

A: Contact the Onondaga County Real Property Services department to report any discrepancies or errors you may find.

Tips for Using the Onondaga County Tax Map

- Utilize the Search Function: The online interface provides various search options, allowing you to find specific properties quickly and efficiently.

- Explore Different Layers: The interactive map features various layers, such as zoning, property ownership, and land use, providing a comprehensive view of the county’s property landscape.

- Consult with Professionals: For complex property transactions or development projects, it is advisable to consult with real estate professionals, attorneys, or other qualified experts.

- Stay Updated: Regularly check the Onondaga County Real Property Services website for updates and changes to the Tax Map.

Conclusion

The Onondaga County Tax Map is an indispensable resource for understanding the county’s property landscape. Its comprehensive data, readily accessible format, and ongoing updates make it a valuable tool for individuals, businesses, and government agencies alike. By providing a transparent and accurate representation of property ownership, zoning regulations, and land use, the Onondaga County Tax Map promotes informed decision-making, fosters economic development, and contributes to a well-managed and efficient property system within the county.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: A Guide to Onondaga County’s Tax Map. We hope you find this article informative and beneficial. See you in our next article!