Navigating The Patchwork: A Comprehensive Guide To Sales Tax By State

By admin / May 10, 2024 / No Comments / 2025

Navigating the Patchwork: A Comprehensive Guide to Sales Tax by State

Related Articles: Navigating the Patchwork: A Comprehensive Guide to Sales Tax by State

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Patchwork: A Comprehensive Guide to Sales Tax by State. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Patchwork: A Comprehensive Guide to Sales Tax by State

The United States boasts a diverse landscape, not just geographically, but also in terms of its tax policies. One of the most prominent examples of this diversity is the state sales tax, a levy imposed on the sale of goods and services. While the federal government does not impose a national sales tax, each state has its own unique system, creating a complex patchwork of rates and exemptions across the nation.

This article aims to provide a comprehensive guide to understanding sales tax by state, illuminating the intricacies of this system and highlighting its implications for individuals and businesses alike.

Understanding the Basics: What is Sales Tax?

Sales tax is a consumption tax levied on the sale of goods and services within a specific jurisdiction. It is typically calculated as a percentage of the purchase price and is collected by the seller, who then remits it to the state government. The revenue generated from sales tax is used to fund various public services such as education, infrastructure, and healthcare.

Navigating the Map: Sales Tax Rates Across the US

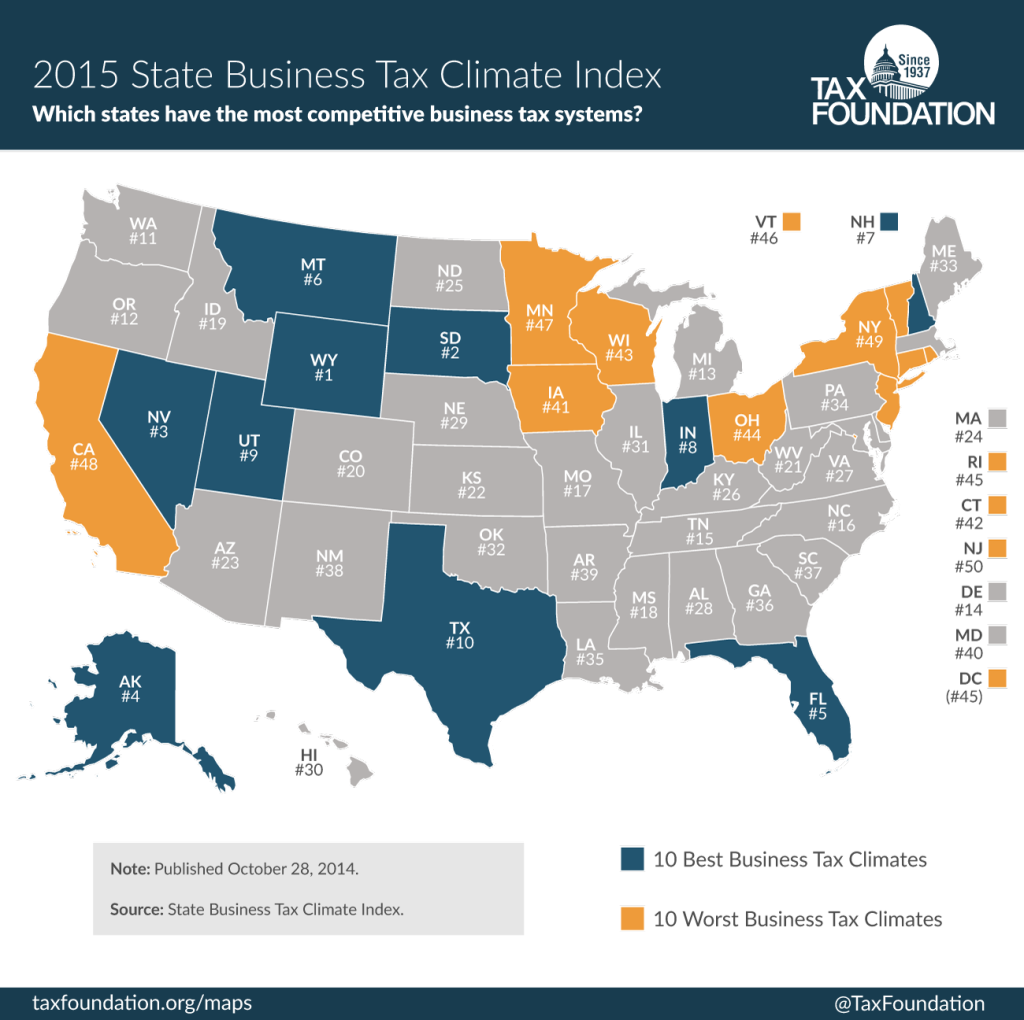

The sales tax landscape in the United States is characterized by significant variation. The following map provides a visual representation of state sales tax rates:

[Insert Map of Sales Tax Rates by State]

Key Observations:

- Wide Range of Rates: The map reveals a significant range in state sales tax rates, from 0% in Alaska, Delaware, Montana, New Hampshire, and Oregon to 7% or higher in states like California, Illinois, and Tennessee.

- Regional Trends: There are observable regional trends in sales tax rates. For instance, states in the Northeast and Midwest tend to have higher rates than those in the South and West.

- Exemptions and Exclusions: While the map depicts the base sales tax rate, it is essential to note that numerous exemptions and exclusions apply. Certain goods and services may be exempt from sales tax entirely, while others may be subject to reduced rates.

Delving Deeper: Understanding the Variations

The differences in sales tax rates and policies across states stem from a variety of factors, including:

- Political Considerations: State legislatures often debate and adjust sales tax rates to reflect their priorities and the needs of their constituents.

- Economic Factors: States with lower sales tax rates may aim to attract businesses and residents by offering a more competitive business environment.

- Social Considerations: Some states may choose to exempt certain goods or services from sales tax based on social or ethical considerations, such as groceries or medical supplies.

Beyond the Base Rate: Exploring the Complexity

The base sales tax rate is only one component of the overall sales tax picture. The true cost of sales tax can be influenced by:

- Local Sales Taxes: Many states allow local governments, such as cities and counties, to impose their own sales taxes, which are often added to the state rate. This creates a complex web of rates that can vary significantly within a single state.

- Exemptions and Exclusions: The availability and scope of exemptions and exclusions can dramatically affect the actual sales tax burden. For example, some states may exempt groceries, clothing, or prescription drugs from sales tax, while others may not.

- Special Taxes and Fees: In addition to the standard sales tax, certain goods and services may be subject to special taxes or fees, such as taxes on gasoline, alcohol, or tobacco.

The Impact of Sales Tax: Implications for Individuals and Businesses

Understanding the intricacies of sales tax is crucial for both individuals and businesses:

Individuals:

- Budgeting and Financial Planning: Consumers need to factor in sales tax when budgeting for purchases, especially for large items like cars or appliances.

- Shopping Decisions: Sales tax can influence purchasing decisions, particularly when comparing prices across states or when considering online purchases from out-of-state retailers.

Businesses:

- Compliance and Reporting: Businesses are responsible for collecting and remitting sales tax to the appropriate state and local governments. This involves complex record-keeping, reporting, and compliance requirements.

- Pricing Strategies: Businesses need to incorporate sales tax into their pricing strategies to ensure profitability and avoid losing customers to competitors with lower prices.

- Competitive Advantage: In some cases, businesses can leverage sales tax exemptions or exclusions to gain a competitive advantage.

FAQs Regarding Sales Tax by State

1. How do I find the sales tax rate for a specific location?

You can access online resources such as the website of the state’s Department of Revenue or the National Conference of State Legislatures (NCSL) to find the sales tax rate for a specific location.

2. What goods and services are exempt from sales tax in my state?

The list of exemptions and exclusions varies by state. Consult your state’s Department of Revenue website for a comprehensive list.

3. Are there any special taxes or fees on certain goods and services?

Many states impose special taxes or fees on specific goods and services, such as gasoline, alcohol, or tobacco. You can find information on these taxes on your state’s Department of Revenue website.

4. How do I register my business to collect and remit sales tax?

The process for registering your business to collect and remit sales tax varies by state. Contact your state’s Department of Revenue for guidance.

5. What are the penalties for failing to collect and remit sales tax?

Penalties for failing to collect and remit sales tax can include fines, interest charges, and even criminal prosecution. It is essential to comply with all sales tax regulations.

Tips for Navigating Sales Tax by State

- Research and Understand: Familiarize yourself with the sales tax laws in your state and any local jurisdictions where you operate or make purchases.

- Use Online Resources: Utilize websites like the NCSL, state Department of Revenue websites, and online sales tax calculators to find accurate information and calculate sales tax.

- Keep Detailed Records: Maintain detailed records of all sales transactions, including the date, amount, and applicable sales tax rate.

- Seek Professional Advice: Consult with a tax professional or accountant if you have complex sales tax needs or require guidance on compliance issues.

Conclusion: The Importance of Understanding Sales Tax

The sales tax landscape in the United States is complex and constantly evolving. Understanding the nuances of sales tax by state is crucial for both individuals and businesses. By navigating this system effectively, consumers can make informed purchasing decisions, and businesses can ensure compliance and maximize their profitability.

Navigating the patchwork of sales tax laws requires diligence and awareness, but with the right tools and resources, individuals and businesses can successfully navigate this complex system and thrive in the diverse economic landscape of the United States.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Patchwork: A Comprehensive Guide to Sales Tax by State. We appreciate your attention to our article. See you in our next article!